Market Insight May 18, 2020

The continued pondering of Wall Street’s “V-shaped recovery” narrative is a sad comedy of epic proportions.

Investors look to the future.

Last week, employment and manufacturing data confirmed that the United States economy continued to strengthen in November, but positive economic news was overshadowed by investors’ concerns about the spread of coronavirus and Federal Reserve policy.

Let’s start with the economic news.

More Americans were working. The Bureau of Labor Statistics (BLS) reported that unemployment dropped to 4.2 percent in November – a level the country wasn’t expected to achieve before 2024, according to Eli Rosenberg of The Washington Post. The labor force participation rate improved, too, meaning that more people are returning to work.

Fewer new jobs were created than analysts expected, but that wasn’t surprising given the BLS’ track record during the pandemic. From June through September, it underestimated employment gains by 626,000, according to Andrew Van Dam of The Washington Post. In the latest report, the BLS revised October’s numbers to be higher by 15,000.

Manufacturing strengthened. The manufacturing industry made gains in November, too. The Institute for Supply Management Purchasing Managers’ Index (PMI) came in at 61.1 for November. The reading for new orders, which measure future demand, was 61.5. “A [PMI] level of 50 indicates that the manufacturing economy is growing. Above 60 is a very strong level,” reported Allen Root of Barron’s.

Positive economic data didn’t inspire investors last week, though. That may be because economic data reflects what has happened in the past. Investors are more concerned about what may happen in the future and how markets may be affected. As a result, investors focused on:

The Omicron variant spread. Last week, a new variant of the coronavirus spread in the U.S. states. Initial indications suggest Omicron may be milder than previous variants, reported Deena Beasley of Reuters. However, that did not quell investors’ concerns. Josh Nathan-Kazis of Barron’s reported:

“Fearing new lockdowns that had been ruled out as recently as a week ago, investors are at times panic-trading based on anecdotes and passing comments by CEOs. The S&P 500 index moved more than 1% nearly every day this week, gyrating up and down on new guesses about what Omicron will mean for the world.”

Federal Reserve policy changes. Investors pondered Fed Chair Jerome Powell’s testimony before the Senate Banking Committee. Powell “…reiterated that he and fellow policymakers will consider at their upcoming meeting a faster wind-down to the Fed's bond-buying program, a move widely seen as opening the door to earlier interest rates hikes,” reported Jonnelle Marte and Lindsay Dunsmuir of Reuters. Historically, rising interest rates have slowed economic growth.

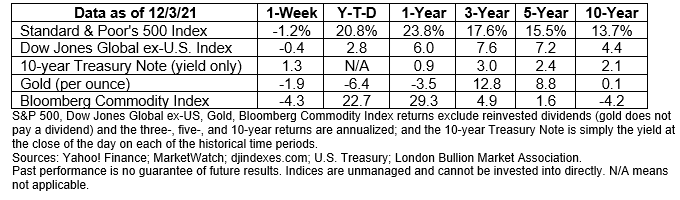

Major U.S. stock indices finished the week lower, according to Ben Levisohn of Barron’s. U.S. Treasury yields moved lower.

The pandemic changed the way we eat – and the way we get our food. The food delivery industry in the U.S. doubled during the pandemic, reported Kabir Ahuja, Vishwa Chandra, Victoria Lord, and Curtis Peens of McKinsey & Company.

One food delivery service recently published the 2021 Cravings Report. It’s chock-full of interesting tidbits about what we like to eat and how we treat the people who deliver our food. Learn more by taking this brief quiz.

1. What was the top-selling delivered grocery item in 2021?

a. Ground beef

b. Bananas

c. Cream cheese

d. Potatoes

2. Which of these states has some of the politest customers in the country?

a. Montana

b. Mississippi

c. New York

d. Missouri

3. Which of these states is not known for its picky eaters?

a. Georgia

b. Illinois

c. Connecticut

d. South Dakota

4. What was the most popular cuisine ordered for delivery in 2021?

a. Thai

b. Italian

c. Mexican

d. Sushi

5. Which of these was the most popular item ordered for delivery?

a. California roll

b. Pizza

c. French fries

d. Pad Thai

“You better cut the pizza in four pieces because I'm not hungry enough to eat six.” —Yogi Berra, baseball player, manager, and coach

Answers: 1) b; 2) a; 3) d; 4) c; 5) c

Best regards,

Niels Buksik

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

The continued pondering of Wall Street’s “V-shaped recovery” narrative is a sad comedy of epic proportions.

Pay close attention and Adapt! There are legions of derisive headlines about a rising stock market attracting "retail traders": What these Wall...

1 min read

The Markets Inflation met expectations. When the Bureau of Labor Statistics released the Consumer Price Index (CPI) last week, it showed that...