1 min read

Market Insight February 1st, 2021

Millions of Americans watched in disbelief as GameStop (GME) shares rocketed to the moon this week. The stock is up 2,400% in the last month. What...

COVID-19 strikes again.

Coronavirus cases have been on the rise in Europe, climbing from about 700,000 new cases a week in September to 2.6 million a week in November, reported Richard Pérez-Peña and Jason Horowitz of the New York Times. As Thanksgiving approached, there was concern that travel and togetherness could increase the number of cases in the United States, too, creating stress on already taxed healthcare systems. Jamie Smyth and Caitlin Gilbert of the Financial Times explained:

“…what was expected to be a celebration has become fraught with danger in some Midwestern states, where vaccination rates are low and COVID-19 cases are rising rapidly after a summer lull…Nationally, cases have increased by nearly 30 percent since the beginning of the month…”

Financial markets took the fall surge in stride. They were less sanguine when news broke last week that a new variant of coronavirus, called “omicron,” had been identified in South Africa and was spreading.

Little is currently known about omicron. In Nature, Ewan Callaway reported the variant has a significant number of mutations, which is concerning. Scientists are tracking omicron’s spread and working to “understand the variant’s properties, such as whether it can evade immune responses triggered by vaccines and whether it causes more or less severe disease than other variants do.”

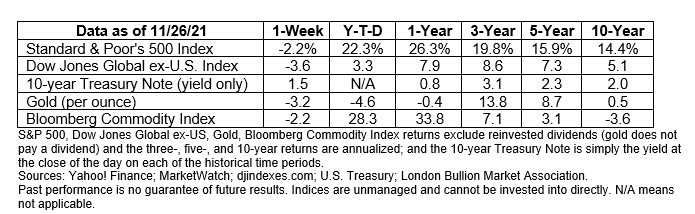

Global stock indices and oil prices dropped sharply on Friday, which was a holiday-shortened trading day, reported Chris Prentice and Carolyn Cohn of Reuters. U.S. Treasury bonds rallied as bond prices were pushed higher by investors seeking lower-risk opportunities. FactSet reported:

“[The Standard & Poor’s 500 Index] logged its worst day since late February and all major indices finished the week in negative territory. All sectors ended lower with moves highly influenced by today's [COVID-19] variant concerns…Healthcare held up best...”

Although it was overshadowed by news of a new coronavirus variant, the pace at which the Federal Reserve will tighten monetary policy (to keep inflation in check) also was on investors’ minds last week. Reuters reported that strategists at Goldman Sachs expected the Fed to tighten faster than anticipated, suggesting that interest rates could move higher sooner.

In 1987, the United Nations Brundtland Commission offered a definition for sustainability: Meeting the needs of the present without compromising the ability of future generations to meet their own needs. Today, innovators are developing goods that enhance our lives and the world around us. Here are a few projects that may intrigue shoe enthusiasts:

When evaluating sustainable fashion, beware of green washing – claims that a company’s products are environmentally friendly when they’re not. As with so many things, it is important to do your own research.

Best regards,

Niels Buksik

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

1 min read

Millions of Americans watched in disbelief as GameStop (GME) shares rocketed to the moon this week. The stock is up 2,400% in the last month. What...

We are now 32 weeks into the onset of the pandemic driven increase in Jobless Claims. Normal State Unemployment Benefits last 26 weeks. Continuing...

2 min read

The Markets Why did stock markets in the United States finish the week lower?If this were Jeopardy, acceptable answers to that question might...