Market Insight February 24, 2020

Risk on or risk off?

Feeling bullish…

Investor bullishness ticked higher last week on all four investor sentiment gauges tracked by Barron’s. Investor optimism may have been fanned by positive financial and economic news. For example, last week

The jobs report was better than expected

Last week, the Bureau of Labor Statistics (BLS) reported that 531,000 new jobs were added in October, lowering the unemployment rate to 4.6%. In addition, the employment numbers for August and September were better than previously reported. The BLS Employment Diffusion Index measures the breadth of employment gains across the economy. It rose from 63.6 in September to 71.8 in October for private industry, and from 57.3 to 70 in manufacturing. The increase suggests that job gains were spread across diverse industries rather than concentrated in specific ones.

Central banks took a measured approach to policy changes.

Companies’ profits increased during the third quarter. So far, 81% of the companies in the Standard & Poor’s 500 Index have reported a positive earnings surprise, reported John Butters of FactSet. (A positive earnings surprise occurs when earnings are better than analysts expected.) So far, the blended earnings growth rate for the S&P 500 was 39.1 percent in the third quarter.

Corporate earnings remained strong.

Companies’ profits increased during the third quarter. So far, 81% of the companies in the Standard & Poor’s 500 Index have reported a positive earnings surprise, reported John Butters of FactSet. (A positive earnings surprise occurs when earnings are better than analysts expected.) So far, the blended earnings growth rate for the S&P 500 was 39.1 percent in the third quarter.

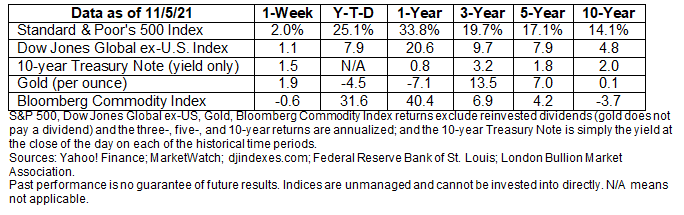

Major U.S. stock indices finished the week at record highs, again, according to Randall W. Forsyth of Barron’s.9 U.S. Treasuries rallied, too.

The recent rapid rise of inflation has many people concerned that we may experience runaway inflation, which occurs when prices rise rapidly, or stagflation, which occurs when economic growth slows while inflation rises. Daco doesn’t believe either will prove to be the case:

“It’s not runaway inflation, and it’s certainly not stagflation…In the debate between transitory and runaway inflation, we have repeatedly said that the truth lies somewhere in the middle, with inflation likely to be ‘sticky but not oppressive.’”

The baseline view from Oxford Economics is that higher inflation will persist into the first half of 2022 before falling back to about two percent by the end of next year. Time will tell.

Last week, the Dow Jones Industrial Average closed at a record high, and the Standard & Poor’s 500 Index and Nasdaq Composite also finished higher, according to Ben Levisohn of Barron’s. The yield on 10-year U.S. Treasuries also moved higher.

Curses often offer explanations for disappointments. The Billy Goat curse on the Chicago Cubs reportedly kept the team from winning a World Series for more than a century. Every actor is wary of the curse of Macbeth, which holds that the play is cursed and brings bad luck to those who perform it.

During the past few years, the term “Infrastructure Week” appeared to be cursed. Every time the White House planned an Infrastructure Week, it was overshadowed by more urgent events, according to Emily Cochrane and Eileen Sullivan of The New York Times. It was concerning because America’s infrastructure isn’t as sound as it once was. The American Society of Civil Engineers (ASCE) has been issuing a Report Card on America’s Infrastructure since 1998, and the best grade earned was a C in 1998.

Last week, the apparent curse was broken when the House of Representatives passed the Infrastructure Investment and Jobs Act (IIJA) with bipartisan support. The bill includes:

Best regards,

Niels Buksik

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Read More

Read More

The Markets Investors were feeling bullish.

It is very important to have a financial plan and investing process that is all about maximizing flexibility and nimbleness. When your personal...