Market Insight March 9, 2020

The Markets Last week, market volatility reached levels that make many investors uncomfortable.

Looking at what was happening in financial markets last week and seeing the complacency in financial markets heading into this latest selloff actually really pisses me off.

Wall Street is basically saying: "The U.S. consumer is in great shape, The U.S. economy is strong, XYZ Tech stock is a secular grower." None of those statements were true. But Wall Street strategists repeated it over and over again. They sucked in a ton of unwitting investors at exactly the wrong time. The retirement accounts of a lot of hard-working Americans have completely collapsed.

Furthermore, I do not believe that this "Volatility" roller coaster ride is anywhere near over. Next month, when companies are legally forced to provide us color on their first Quarter operations, reality and expectations will have to be reconciled. We anticipate that CEOs & CFOs will be aggressively taking down their 2020 Earnings estimates and, potentially, total employment alongside it.

I can't overstate how important it is to manage the risk your portfolio is taking on especially as "the Financial Winter is not only coming, but it's already here".

When the global economy (which in China, Europe, and Emerging Markets have been slowing, in math terms, for over 2 years now) slows at its fastest pace, people get scared and go to cash. The US Dollar remains the world’s reserve currency and should be considered as an option in your portfolio.

The coronavirus (COVID-19) continued to spread across the United States last week.

On Friday, March 13, the Centers for Disease Control (CDC) reported there were 1,629 confirmed and presumptive cases and 41 deaths. Last Friday, March 20, the numbers had increased to 15,219 cases and 201 deaths.

Governments in several states – including California, Colorado, Connecticut, Florida, Georgia, Idaho, Illinois, Louisiana, Maine, New Jersey, and New York – have issued shelter-in-place orders that apply to the entire state or one or more counties within the state. The intent is to enforce social distancing and slow the spread of COVID-19, reported Wired.

Mandates varied by region. Many included closing non-essential businesses and required residents to stay home unless they were buying groceries or gasoline, filling prescriptions, seeking medical care, or exercising outdoors (while practicing social distancing).

The shape of many Americans’ daily lives has changed significantly. Last week, Barron’s reported initial claims for unemployment benefits in the United States increased sharply, while U.S. manufacturing productivity dropped significantly.

The impact of measures taken to fight the spread of COVID-19 on companies, financial markets, and the economy is difficult to quantify at this point. However, Wall Street believes that there is reason to hope it will be relatively brief. The Economist reported:

“Despite stomach-churning declines in GDP [gross domestic product, which is the value of goods and services produced in a nation or region] in the first half of this year, and especially the second quarter, most forecasters assume that the situation will return to normal in the second half of the year, with growth accelerating in 2021 as people make up for a lost time.”

This is absolutely crazy and it is one of many reports I have read or interviews I have listened to last week that ponder this kind of thinking. The complacency is mind-blowing. Most of the 20 something-year-old analysts have never seen nor modeled a company with negative earnings growth.

The monetary stimulus will have a significant impact on outcomes around the globe. Central banks have been implementing supportive monetary policies. Last week, the Federal Reserve lowered its benchmark rate to near zero, announced a new round of quantitative easing, and took additional steps to inject liquidity into markets.

Fiscal stimulus – the measures implemented by governments – will also be critical. To date, the United States has passed two stimulus measures. The first provided $8.3 billion in emergency funding for federal agencies to fight COVID-19. The second is estimated to deliver about $100 billion for testing, paid family and sick leave (two weeks), funds for Medicaid and food security programs, and increases in unemployment benefits. The third stimulus is currently being negotiated in Congress and may provide more than $1 trillion dollars in relief to individuals and companies, reported Axios. On Sunday, Reuters reported the Senate planned to vote on the bill on Monday, March 23, 2020.

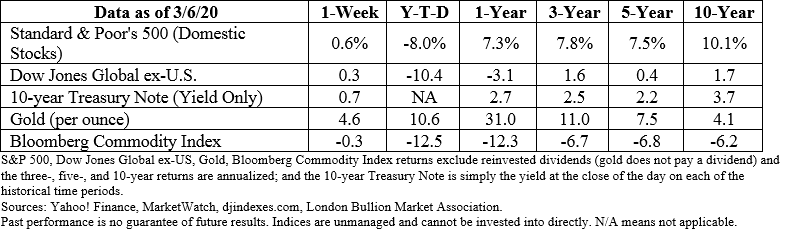

Major U.S. stock indices finished last week lower, reported CNBC.

We hope you and your family are well and remain so. Please take the precautions advised by your city, state, and federal governments to limit the advance of COVID-19.

The temporary closing of non-essential businesses, shelter-in-place orders, and other changes that have come with efforts to keep COVID-19 from overwhelming hospital and healthcare facilities are creating economic challenges for many families. Here are four support and stimulus measures that may help.

1. Financial support from banks and financial companies. Americans who find themselves without work or working fewer hours may want to contact their banks. CNBC reported some banks and financial companies are willing to provide support during this difficult time, including:

• Deferring payments on the mortgage, auto, and other personal loans

• Deferring payments on small business loans

• Waiving customer overdraft, expedited check, and debit card fees

• Waiving customer fees on excessive savings account withdrawals

• Waiving penalties for early withdrawals from certificates of deposit

• Refunding overdraft, insufficient funds, and monthly maintenance fees for the bank and small business customers

• Pausing foreclosures, evictions, and repossessions

• Offering economic disaster loans

Customers must contact their banks to request support.

2. Tax Day postponement to July 15. The Internal Revenue Service pushed the 2019 tax filing deadline from April 15, 2020, to July 15, 2020. The three-month delay is intended to help Americans cope with the financial effects of COVID-19, reported CNBC. If you expect a refund, you may want to file sooner.

It is unclear whether 2019 contributions to IRAs must be made by April 15, 2020. Also, the deadline for filing taxes in your state may remain unchanged. Check with your state’s treasury office.

3. Stimulus checks from the government. The details are not yet available, but it appears the bill currently being debated in Congress may include stimulus checks for Americans. The proposals vary so it is impossible to provide specifics right now, according to Kiplinger.

4. Paid and family sick leave. On March 18, the Families First Coronavirus Response Act was passed. The new law requires employers with fewer than 500 workers to provide up to 80 hours of paid sick leave to employees affected by COVID-19. You qualify to receive your full wages (up to $511 per day) while on paid leave if you are sick or quarantined.

If you are caring for someone who is ill with coronavirus, or you are home caring for children, then you qualify to receive two-thirds of wages (up to $200 a day).

Go to Kiplinger.com to see if any other assistance may apply to you.

“In the midst of every crisis, lies great opportunity.”

--Albert Einstein, Physicist

The Markets Last week, market volatility reached levels that make many investors uncomfortable.

Many millions of Americans are struggling right now, and it's really really sad. The crushing economic toll of COVID-19 is creating huge cracks in...

The Markets Students of financial markets may have noted a historically unusual event last week.