6 Surprising Costs of Motherhood

While bringing a baby into this world is an exciting and fulfilling experience, it comes with numerous implications that may be overlooked. According...

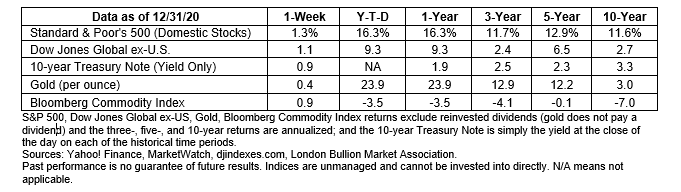

Last week was the cherry on top of a turbulent year for investors.

After the $900 billion fiscal stimulus bill was signed on Sunday, major U.S. stock indices moved higher. The Washington Post reported, “The S&P 500-stock index, the most widely watched gauge, is finishing the year up more than 16 percent. The Dow Jones Industrial Average and the tech-heavy Nasdaq gained 7.25 percent and 43.6 percent, respectively. The Dow and S&P 500 finished at record levels despite the public health and economic crises.”

U.S. Treasuries gained, too, as yields moved slightly lower. Thirty-year Treasuries finished the week yielding 1.65 percent. While government bonds didn’t offer attractive levels of income during the year, they “…lived up to their billing as a stock market hedge in 2020. Rates plunged as stocks collapsed in March, and the Treasury market finished 2020 with yields not much above the pandemic panic lows and down half a percentage point or more for the year,” reported Barron’s.

The Year in Review

Early in 2020, despite the COVID-19 outbreak in Wuhan, China, the possibility of a global pandemic was not on investors’ minds. Financial markets were concerned about:

Slowing U.S. economic growth

Rising tensions between the United States and Iran

Ongoing trade tensions between the United States and China

The pending U.S. presidential election

The United Kingdom’s Brexit negotiations

As the COVID-19 virus began to spread across the globe, stock markets dropped sharply around the world and the longest bull market in U.S. history came to an end. The downturn reflected doubts about the U.S. government’s response to the crisis. In mid-March, Axios reported, “While central banks around the world are stepping in, it’s unclear what measures – if any – the Trump administration will be able to get through Congress to stem the economic pain.”

Before the end of the month, attitudes shifted as Congress responded to the coronavirus juggernaut bypassing the $2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act. The measure received overwhelming bipartisan support and was quickly signed into law.

The CARES Act and central bank support inspired optimism in financial markets. The bear market in the S&P 500 Index became the shortest in history, lasting just 33 days, according to Reuters. From late March through August, despite significant economic damage and persistent virus spread, the S&P 500 recovered its losses, gaining about 55 percent.

The economy also began to recover in the second quarter, and the United States saw gains in employment, consumer spending, and other economic data, reported Deloitte. However, by late July, there were signs the recovery might be faltering.

“Daily credit card spending, which by early April had declined 32 percent from the pre-COVID level, was up to just 4.7 percent below the pre-COVID level on June 22. But, by July 19, it was falling, down 6.4 percent. Initial weekly claims for unemployment insurance stalled at 1.4 million – a huge number suggesting that job losses were continuing. And, the Census Bureau’s weekly Household Pulse survey found more people unemployed in late July than at the beginning of the month,” reported Deloitte.

Congress went back to work and spent much of the latter half of 2020 negotiating a new stimulus bill, which passed last week, and $600 stimulus checks have begun arriving in Americans’ bank accounts. In the meantime, several COVID-19 vaccines have been developed and approved, and inoculations have begun in several countries.

Vaccine availability boosted financial market optimism. Investors anticipate vaccines will bring the coronavirus under control and usher in a return to business-as-usual by mid-2021, reported CNBC.

We wish you a happy and prosperous New Year!

Dogs may be some of the world’s most effective disease detectives.

In January, before COVID-19 was known to have arrived on our shores, NPR wrote about the dogs’ ability to smell disease. The host of Medical Monday interviewed Maria Goodavage, author of Doctor Dogs: How Our Best Friends Are Becoming Our Best Medicine, who said:

“With ovarian cancer, there's not much great testing for early detection. I heard about these dogs at the University of Pennsylvania Veterinary Working Dog Center that are able to smell ovarian cancer. They're able to detect it as early as stage one. We're not even talking tumors here. They're able to detect ovarian cancer in one drop of plasma from a woman with ovarian cancer.”

Doctor dogs also are being trained to detect the novel coronavirus. Reuters reported, “A study recently found dogs can identify infected individuals with 85 percent to 100 percent accuracy and rule out infection with 92 percent to 99 percent accuracy.”

Airports in Chile, the United Arab Emirates, and Finland have begun using teams of dogs to identify passengers who may be afflicted with the disease. Passengers and dogs do not interact directly. Instead, volunteers wipe gauze over their necks and wrists and place the gauze in a jar. The dogs smell the gauze to determine if COVID-19 is present.

Dog disease detectives could help restore consumer confidence in air travel and provide a layer of protection against infection. If the dogs are successful in airports, they may be deployed to hospitals, nursing homes, sports venues, and cultural events, said a Finnish professor of equine and small animal medicine who was cited by AFAR.com.

“A person can learn a lot from a dog, even a loopy one like ours. Marley taught me about living each day with unbridled exuberance and joy, about seizing the moment and following your heart. He taught me to appreciate the simple things – a walk in the woods, a fresh snowfall, a nap in a shaft of winter sunlight. And, as he grew old and achy, he taught me about optimism in the face of adversity. Mostly, he taught me about friendship and selflessness and, above all else, unwavering loyalty.”

--John Grogan, Author

Best regards,

Niels Buksik

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

__________

* These views are those of ANCHORY LLC, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

*This newsletter was prepared by ANCHORY LLC.

*Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

*Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price,yield, maturity, and redemption features.

*The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

*All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

*The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

*The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower,investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

*Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

*The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

*The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

*The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

*The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

*International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

*Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

*The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

*Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

*Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

*Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

*There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

*Asset allocation does not ensure a profit or protect against a loss.

While bringing a baby into this world is an exciting and fulfilling experience, it comes with numerous implications that may be overlooked. According...

1 min read

The Markets Last week, the January stock market decline was interrupted by a Friday afternoon rally. “The S&P 500 rose 2.4 percent, its biggest...

The Markets There was a swing…. and a (massive) miss on Friday’s jobs report: US Unemployment came in at 3.9% (down from 4.2% and undershot...