2 min read

Market Insight February 14, 2022

The Markets Why did stock markets in the United States finish the week lower?If this were Jeopardy, acceptable answers to that question might...

Last week, the January stock market decline was interrupted by a Friday afternoon rally.

“The S&P 500 rose 2.4 percent, its biggest one-day jump since June 2020, while the technology-heavy Nasdaq composite rose 3.1 percent. Friday’s gain snapped a three-day streak of losses and left the S&P 500 up 0.8 percent for the week, its first weekly gain this year,” reported Coral Murphy Marcos of The New York Times.

The change in direction may have reflected:

It’s difficult to know which direction markets will go next; however, an asset manager cited by Nicholas Jasinski of Barron’s characterized the January drop as:

“…a ‘garden variety technical correction,’ as opposed to a more pernicious cyclical downturn or systemic problem facing the market. Stocks aren’t falling because analysts are lowering profit forecasts en masse, or because economists are predicting a recession on the horizon. Instead, the correction has taken place because of how richly the market is valued.”

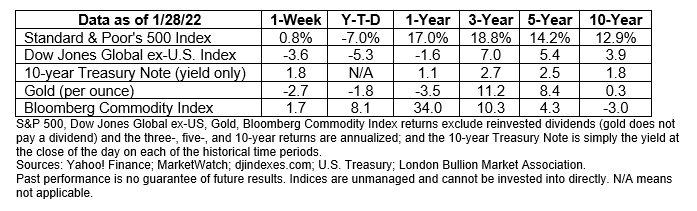

Major U.S. stock indices were flat or up for the week, according to Al Root of Barron’s. The yield on 10-year U.S. Treasuries rose during the week before subsiding.

Space exploration is making a comeback. Bill Nye, the Science Guy, and Ms. Frizzle of Magic School Bus fame both have series featuring outer space. Venture capital firms have begun to spend more than ever before on space companies. They invested $17.1 billion in 2021, up from $9.1 billion in 2020, reported Space Investment Quarterly. And the Bureau of Economic Analysis has begun developing statistics to measure the contributions of space-related industries to the U.S. economy.

See what you know about the space economy by taking this brief quiz.

1. At the end of 2021, how many active satellites were in orbit around the Earth?

a. 100 to 500

b. 500 to 5,000

c. 5,000 to 10,000

d. More than 10,000

2. In 2019, a European spacecraft had to perform an evasive maneuver to avoid a collision with a private company’s satellite. As the space economy grows and space gets more crowded, the world may need:

a. Space traffic awareness

b. A regulatory framework defining space rights of way

c. Cooperation between multiple nations

d. All of the above

3. Which country has an ambitious five-year plan for spaceflight and exploration?

a. United States

b. Russia

c. China

d. Sweden

4. Several companies are using satellite technology to search for solutions to climate issues. These companies are:

a. Monitoring global emissions

b. Improving agricultural crop growth

c. Identifying targets for conservation and reforestation investment

d. All of the above

“The Earth is the cradle of humanity, but mankind cannot stay in the cradle forever.”

—Konstantin Tsiolkovsky,scientist

Answers: 1) c; 2) d; 3) c; 4) d

Best regards,

Niels Buksik

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

2 min read

The Markets Why did stock markets in the United States finish the week lower?If this were Jeopardy, acceptable answers to that question might...

Would like to take a moment during these truly historic times to thank you and all of our subscribers for placing your trust in ANCHORY. What we are...

We are now 32 weeks into the onset of the pandemic driven increase in Jobless Claims. Normal State Unemployment Benefits last 26 weeks. Continuing...