The Markets

2021 was a fizzing mints-in-soda kind of year!

Everything seemed to shoot higher – from COVID-19 cases and vaccinations to economic growth and global stock markets. Everything except for optimism. As the year came to an end, a CBS News poll found that 40 percent of Americans felt 2021 was mostly filled with sadness, although almost three out of four people polled said they were hopeful for 2022.

As we head into the new year, let’s look back at 2021.

- Vaccinations took off. At the start of the year, very few people were vaccinated against COVID-19. Despite issues with vaccine reluctance and availability, by the end of the year, more than 58 percent of the world’s population had received at least one dose of a COVID-19 vaccine.

The United Arab Emirates led the way with 99 percent of the nation’s population vaccinated. Nigeria lagged with about 95 percent of the population unvaccinated. More than 61 percent of Americans were fully vaccinated, and another 12 percent were partially vaccinated, according to Our World in Data. - United States’ economic growth was stronger than it has been in decades. In December, The Conference Board estimated the U.S. economy grew by 6.5 percent annualized in the fourth quarter of 2021, and 5.6 percent over the full year. That’s the strongest growth in decades, according to Ben Levisohn of Barron’s. The publication reported the lesson of the last century is, “Don’t underestimate the resilience of the U.S. economy.”

- Inflation rose faster than it has in decades. Consumer prices increased at the fastest pace since 1982. By December, prices were up almost 7 percent for the year in the U.S., according to The Economist. As rents and wages increased, the Federal Reserve changed the language it used when discussing inflation, removing the word “transitory.” Some economists say inflation will subside in 2022, while others believe it will be more enduring, according to a report from Goldman Sachs.

- Consumer sentiment declined and then rose in December. Overall, consumers were less optimistic during 2021, largely because of inflation. About 25 percent of households said inflation was eroding their standard of living.

In December, however, optimism moved sharply higher “…primarily due to significant gains among households with incomes in the bottom third of the distribution. Indeed, the bottom third expected their incomes to rise during the year ahead by 2.8%, up from 1.8% last December,” reported Richard Curtin, the University of Michigan’s Surveys of Consumers chief economist. That’s the biggest gain in 22 years. - The Federal Reserve took a hawkish turn. As inflation persisted, the Fed decided to accelerate monetary policy tightening by tapering bond purchases more quickly than expected. In December, 12 of the 18 Federal Open Market Committee members indicated they anticipate at least three rate hikes in 2022. The increases would lift the Fed funds rate from zero to 0.25 percent to 0.75 to 1.0 percent.

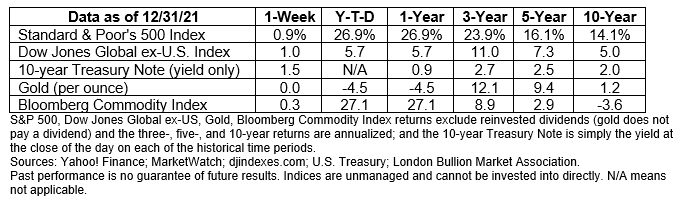

- Major U.S. stock indices set record after record. After trading closed on December 31, 2021, “All three major U.S. stock indexes scored monthly, quarterly and annual gains, notching their biggest three-year advance since 1999,” reported Stephen Culp and Echo Wang of Reuters.

- Corporate earnings proved resilient. Despite supply chain issues, labor shortages, wage increases and inflation, U.S. company earnings were exceptional. Earnings, which reflect company profits, were up 45.1 percent year-over-year. That’s well above the trailing 10-year average annual earnings growth rate of 5.0 percent, according to John Butters of FactSet.

- China cracked down on “capitalist excesses.” “More than $1trn was wiped off the collective market capitalization of some of the world’s largest internet groups...Entire business models – online tutoring, for example – were laid waste. Investors needed to hear that an end was in sight. But on August 8th the Communist Party issued a five-year blueprint aimed at reshaping China’s tech industry – confirming to even the most optimistic industry watchers that the abrasive changes would continue well into 2022,” explained The Economist.

- Finding income in the bond market was challenging. “Emerging-market bonds were supposed to be dragged down this year as central banks moved toward withdrawing stimulus. Instead, the best-performing global debt was all from developing nations…South Africa, China, Indonesia, India and Croatia topped the rankings of 46 markets around the world in 2021,” reported Lilian Karunungan and Masaki Kondo of Bloomberg.

s

Despite the July to September slowdown in GDP, corporate earnings remained unusually strong. Earnings are a measure of companies’ profitability, Analysts estimated that the corporate earnings growth rate for 2021 is 45.1 percent, year-over-year. That’s well above the trailing 10-year average annual earnings growth rate of 5 percent, reported John Butters of FactSet.

All sectors of the S&P 500 Index are expected to have had positive year-over-year earnings growth in 2021. Energy, Industrials, Materials, Consumer Discretionary and Financials sectors have experienced the strongest growth.

We hope the new year is filled with good health and prosperity.

THE LATEST FASHION: RESALE AND REUSE...If

If there was a spectrum that reflected the value and longevity of everything we owned, consumables (coffee and cell phones) might be at one end, durables (automobiles and appliances) in the middle, and items with enduring value (homes and collectibles) on the other end, according to The Economist.

Clothing might belong to different parts of the spectrum. Everyday socks might be on one end while Audrey Hepburn’s little black dress from Breakfast at Tiffany’s and Neil Armstrong’s Apollo 11 spacesuit ranged toward the other end.

Currently, people spend less on clothes, overall, but buy more than they once did. Often, items are worn a few times and then discarded. As a result, the fashion industry has a sustainability problem. The Economist reported:

“…industry studies reckon that clothing manufacture and distribution account for between 2% and 8% of global carbon emissions. The fashion industry probably emits more carbon than aviation (3% of emissions) or shipping (2%).”

With consumers prioritizing sustainability, fashion has begun to change. More people are cleaning out their closets and selling clothing online, according to the 2021 Resale Report. As a result, the resale clothing marketplace is expected to double, reaching $77 billion, during the next five years.

That may be the tip of the iceberg. Thirty-six billion pieces of clothing are thrown out by Americans each year, and estimates suggest that 95 percent could be recycled or reused.

Weekly Focus – Think About It

“Hope, Smiles from the threshold of the year to come, Whispering ‘it will be happier...”

—Alfred Lord Tennyson, poet

Best regards,

Niels Buksik

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

.jpg) Niels Buksik

Niels Buksik