Market Insight January 25th, 2021

Pay close attention and Adapt! There are legions of derisive headlines about a rising stock market attracting "retail traders": What these Wall...

Investors were feeling bullish.

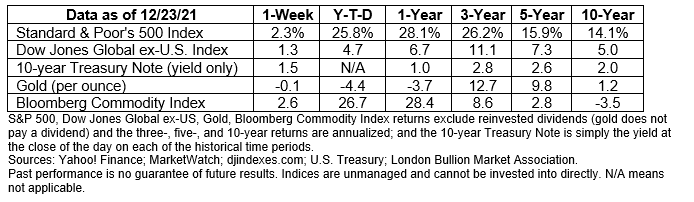

Last week, the Standard & Poor’s 500 (S&P 500) Index closed at a record high for the 68th time this year. That’s the second-highest number of record closes in a single year. The highest number occurred during 1995 when the S&P 500 had 77 record highs, reported Reuters. That was the year the Dow Jones Industrial Average passed 4,000 for the first time and then rose above 5,000, reported Wayne Duggan of Benzinga.

“The market deserves to celebrate. [COVID] brought death and dislocation, but we tend to pay too little heed to what didn’t happen. If vaccines hadn’t changed the pandemic’s trajectory, the U.S. would have suffered nearly 1.1 million additional deaths and 10 million more hospitalizations – according to an epidemiological model by the Commonwealth Fund cited this past week in the Journal of the American Medical Association,” reported Bill Alpert of Barron’s.

That may be the case, but investors were likely focused on expectations for consumer sentiment, economic growth, and corporate earnings.

The Conference Board reported that the consumer outlook for income, business, and labor market conditions improved significantly in December, rising from 90.2 to 96.9. A growing share of survey respondents plans to buy houses, cars, and major appliances during the next six months. The number of people planning vacations increased, too, reported Lucia Mutikani of Reuters.

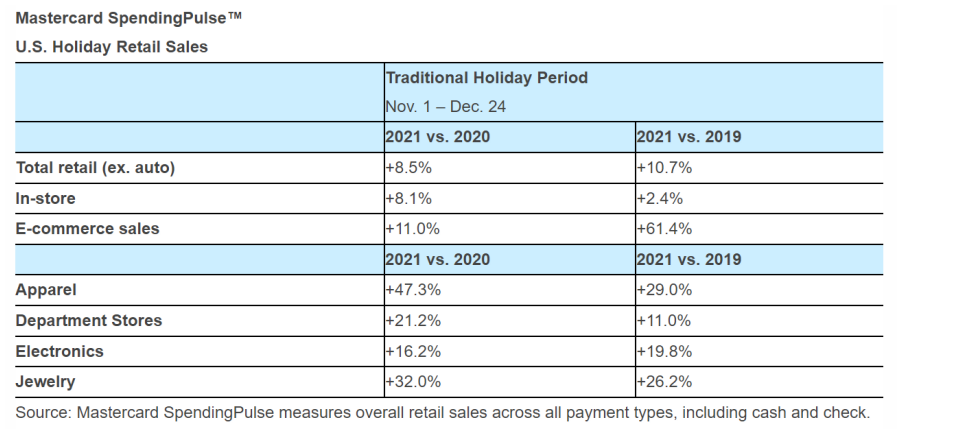

Consumer optimism could bode well for economic growth, which was robust in 2021, up 6.3 percent in the first quarter of the year, 6.7 percent in the second quarter, and 2.3 percent in the third quarter. The U.S. Bureau of Economic Analysis reported, “From the second quarter to the third quarter, spending for goods turned down (led by motor vehicles and parts) and services decelerated (led by food services and accommodations).” However, We were expecting strong holiday sales results for retail, and early data is indicating we got that

Despite the July to September slowdown in GDP, corporate earnings remained unusually strong. Earnings are a measure of companies’ profitability, Analysts estimated that the corporate earnings growth rate for 2021 is 45.1 percent, year-over-year. That’s well above the trailing 10-year average annual earnings growth rate of 5 percent, reported John Butters of FactSet.

All sectors of the S&P 500 Index are expected to have had positive year-over-year earnings growth in 2021. Energy, Industrials, Materials, Consumer Discretionary and Financials sectors have experienced the strongest growth.

We hope the new year is filled with good health and prosperity.

If you had to describe 2021 with a single word, what would you choose? Innovative? Frustrating? Too much? Something saltier? It certainly wasn’t an easy year but, in many ways, it was better than the preceding one. As we say goodbye to 2021, let’s not forget:

By the way, Dictionary.com chose ‘Allyship’ as its word of the year. The Oxford Languages chose ‘Vax,’ and Australia’s Macquarie Dictionary chose ‘Strollout’ (in recognition of the country’s slow vaccine rollout).

“Be at war with your vices, at peace with your neighbors, and let every new year find you a better person.” —Benjamin Franklin, writer

Best regards,

Niels Buksik

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Pay close attention and Adapt! There are legions of derisive headlines about a rising stock market attracting "retail traders": What these Wall...

1 min read

The Markets It’s MESSI! No, this commentary is not about Lionel Messi, the Argentine soccer phenom who is widely regarded one of the greatest...

1 min read

The Markets Thinking about the possibilities. The Standard & Poor’s (S&P) 500 Index finished last week slightly higher and has gained about 6 percent...