MOST INVESTORS ARE HOPING FOR AN ECONOMIC RESURGENCE

Unfortunately, hope is not a good way of managing risk and it looks like we could be at a critical inflection point and if investors don't watch out they could be in for a world of hurt. Keep a close eye on Consumer Confidence and Jobless Claims. There are very few things that are more important than the job of a human being and their confidence about their future.

THE MARKETS

The stock market rallies like it’s 1986.

August has been a good month for stock investors. At the end of last week, the S&P 500 Index was up 6.8 percent for the month. The Index is poised to deliver its best returns for the month since 1986, when it gained 7.1 percent, reported Financial Times.

The performance of U.S. stock markets is remarkable, in part, because, so far, company earnings – the profit that publicly-traded companies earn and report each quarter – haven’t been great in 2020. Earnings were down 31.9 percent during the second quarter of the year, reported FactSet. The decline in earnings reflected the impact of coronavirus closures.

Weak second quarter earnings had little impact on U.S. stocks, however. Instead, investors appeared to focus on ‘upside earnings surprises.’ That term is used to describe companies with earnings that exceed analysts’ expectations. During the second quarter, 84 percent of companies in the S&P 500 beat analysts’ estimates.

FactSet reported other factors have been cited to explain the upward trajectory of stock markets, as well. These include:

• Improved earnings sentiment

• Expectations for additional fiscal stimulus

• Optimism about coronavirus treatments and vaccines

• Fear-of-missing-out (FOMO) as the market moves higher

The list should also include the Federal Reserve’s strategy for inflation and employment, which was announced last week. Randall Forsyth of Barron’s reported:

“In practical terms, the central bank’s current policy of near-zero interest rates and heavy purchases of Treasury and agency mortgage-backed securities will continue as long as unemployment remains elevated. The chasm between a Wall Street at record levels and a Main Street in a near-depression will persist as a result.”

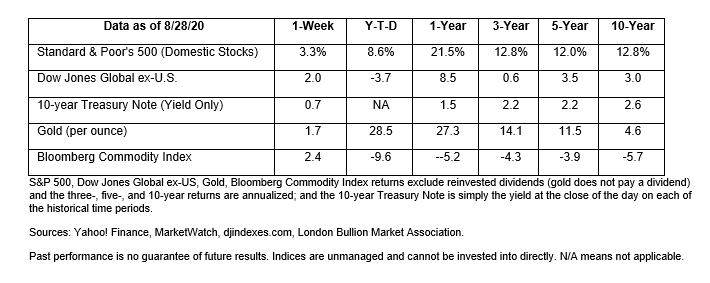

Last week, the Standard & Poor’s 500 and Nasdaq Composite Indices chalked up a fifth consecutive week of gains, while the Dow Jones Industrial Index moved into positive territory for 2020.

COULD YOU PASS THE AMERICAN CITIZENSHIP TEST?

It’s not easy to become an American citizen. In fact, newly-minted citizens may know more about the history of the United States than many of us who were born here. In 2018, a national survey reported just one-in-three Americans scored 60 percent or better on a multiple-choice test that included questions from the U.S. Citizenship Test.

See what you know about the United States by taking this brief quiz:

1. What does the Constitution do?

a. Defines the government

b. Sets up the government

c. Protects basic rights of Americans

d. All of the above

2. Name one of the two longest rivers in the United States.

a. Mississippi River

b. Colorado River

c. Ohio River

d. Rio Grande River

3. What did Susan B. Anthony do?

a. Founded the Red Cross

b. Made the first flag of the United States

c. Fought for women’s rights

d. Was the first woman elected to the House of Representatives

4. Which statement correctly describes the “rule of law?”

a. The law is what the president says it is

b. The people who enforce the laws do not have to follow them

c. Judges can rewrite laws they disagree with

d. No one is above the law

5. When was the Constitution written?

a. 1492

b. 1776

c. 1787

d. 1865

6. Name your U.S. Representative.

Weekly Focus – Think About It

“When humor goes, there goes civilization.”

--Erma Bombeck, Humorist, writer, columnist

Quiz Answers:

1. D – All of the above (Defines the government;Sets up the government; Protects basic rights of Americans)

2. A – Mississippi River

3. C – Fought for women’s rights

4. D – No one is above the law

5. C – 1787

6. Look up your representative at https://www.house.gov/representatives/find-your-representative

Best regards,

Niels Buksik

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

* These views are those of ANCHORY LLC, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

*This newsletter was prepared by ANCHORY LLC.

*Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

*Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price,yield, maturity, and redemption features.

*The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

*All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

*The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

*The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower,investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

*Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

*The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

*The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

*The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

*The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

*International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

*Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

*The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

*Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

*Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

*Past performance does not guarantee future results. Investing involves risk,including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

*There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

*Asset allocation does not ensure a profit or protect against a loss.

.jpg) Niels Buksik

Niels Buksik