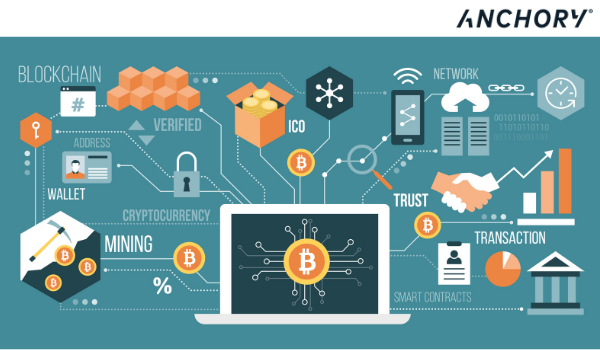

What is the Blockchain?

If you are new to the world of cryptocurrencies, you have probably heard or seen the word blockchain somewhere. It is one of those common jargons in...

While bringing a baby into this world is an exciting and fulfilling experience, it comes with numerous implications that may be overlooked. According to the Pew Research Center, while women in the U.S. are waiting longer to have children than before, they are “still starting their families sooner” than women in other developed countries. In fact, the average age of women in the U.S. becoming first-time mothers is about 26-years-old.

Additionally, when compared to the 1990s, parents are now spending more time and money on child care, signifying a heightened concern for children’s overall well-being during their developmental years.

From child care to higher education, there is a multitude of expenses to consider before starting your own family. While motherhood could add more meaning and purpose to your life, evaluating your own financial standing before conceiving could prevent you from spending more time worrying than enjoying the experience. When it comes to motherhood, there are six surprising costs you want to be well-prepared for before you enter the delivery room and become responsible for another individual.

Often called the “motherhood penalty,” a study found that children born to or adopted by a woman left the mother with an income decrease of four percent. While this number may not seem substantial, four percent can add up quite quickly when paying for food, diapers and baby sitters. Interestingly enough, that same study found that the father’s income rose by six percent, which is often referred to as the “fatherhood premium.”

While many expectant mothers may assume insurance will cover the hospital bill for delivery, depending on your policy, you could very well have a deductible to pay before your insurance covers costs, which could amount to well above a hundred or even thousands of dollars. This often surprises many families who are not prepared for the hospital bill they receive post-birth. And considering how many new costs you incur when you become a mother, every dollar counts. A good rule of thumb is to ask your chosen hospital beforehand what your out-of-pocket expenses will be up-front to be fully prepared.

While you may think breastfeeding is technically free, there are accessories associated with the practice that you wouldn’t necessarily expect. Breast pumps, nursing bras and special pillows all have a price tag attached to them, and if you’re serious about breastfeeding, you’ll likely want to have all three just in case. And while we all hope there are no issues, trouble with breastfeeding can be a cost-inducing factor as well. Consulting with a certified lactation specialist can quickly add up as well, with appointments costing between $200 and $350.

Even when your child is being taken care of by your spouse or a trusted friend, you never know what could happen while you’re away. From unexpected illnesses to sudden dietary needs, a baby could have you leaving work for more than just your normal lunch break. While some employers are understanding, not everyone understands the unpredictability that goes along with having a child.

As your child grows older, there are more moments you may not want to miss, like soccer games, dance recitals and school presentations. Some of these events take place during working hours, and you are not always able to fit them into your schedule. However, if your job already offers more flexible work options — such as working remotely — you may not have as many scheduling conflicts to navigate as you raise your child.

Even if you’re not expecting a child, even just the impression that you may be having a baby soon could prevent your employer from assigning you to higher-level, more time-consuming projects. And once you have a child, your employer may not consider you for a promotion as seriously as they would when compared to a woman without a child (terrible, but we know it happens). According to a study by researchers at Cornell University, “mothers were penalized on a host of measures, including perceived competence and recommended starting salary.” Interestingly enough, “men were not penalized for, and sometimes benefited from, being a parent.” It’s an unfortunate reality for many women that with more responsibility in their personal life comes a diminished perception of their workplace potential.

Although most parents plan ahead for childcare costs, many may not realize that the costs for child care are rising steadily each year. According to Child Care Aware of America (CCAA), “Parents across the country spent $9,000 to $9,600 annually for one child’s daycare in 2019, up roughly 7.5 percent on the year.”8 In fact, these expenses can eat up almost 40 percent of a single parent’s household income.8 And while you may expect your child’s college tuition to be the largest cost, CCAA reports that childcare can actually add up to be “roughly double the price of a year’s tuition to an in-state public university.”8 So, before you start worrying about where they’re going to go to college and how you are going to pay for it, be sure to factor in childcare costs first.

https://www.childcareaware.org/our-issues/research/the-us-and-the-high-price-of-child-care-2019/

While motherhood comes with its own unique costs (both tangible and intangible), raising a child can be an extremely rewarding experience. In order to make the most of parenthood, take some time to educate yourself so you’re well prepared for what lies ahead. From online articles and forums to your friends and family members, there are a variety of avenues you can take to gain more insight into motherhood and the financial implications of this exciting new chapter.

https://www.pewresearch.org/fact-tank/2018/06/28/u-s-women-are-postponing-motherhood-but-not-as-much-as-those-in-most-other-developed-nations/

https://www.nber.org/papers/w24740

https://www.russellsage.org/publications/changing-rhythms-american-family-life-1

https://www.thirdway.org/report/the-fatherhood-bonus-and-the-motherhood-penalty-parenthood-and-the-gender-gap-in-payhttps://www.mamanatural.com/how-to-find-a-lactation-consultant/https://

https://www.marketwatch.com/story/child-care-costs-just-hit-a-new-high-2018-10-22

This content is developed from sources believed to be providing accurate information, and provided by ANCHORY LLC. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

If you are new to the world of cryptocurrencies, you have probably heard or seen the word blockchain somewhere. It is one of those common jargons in...

For many, it can be a challenge to keep their emotions in check when it comes to investing. Staying steady as you watch the stocks you’ve invested in...

Whether you knew about the inheritance or not, it can be overwhelming to receive a lump sum of money or property. The key is to keep a level head...